It has been an eventful start to 2023 for the economy and capital markets. Many investors came into the year anticipating that the onset of a mild mid-year recession would finish the job of bringing inflation back down, providing the U.S. Federal Reserve with the flexibility to get back to the lower interest rates that the markets have come to know and love for so many years now. But after the first three months of the year that brought us first a surprisingly strong economy and stubborn inflation pressures followed by a series of bank failures, the outlook has notably shifted. So where do we stand today? And what should we reasonably expect as the weather warms through the spring and into the summer months.

Resilience. What has arguably been the most impressive characteristic of the U.S. stock market so far this year has been its resilience. Despite being confronted with stubbornly high inflation that was dashing the hopes of Fed rate cuts sooner rather than later followed by a few weeks in March where we once again found ourselves on the brink of financial meltdown, stock investors not only acted with a collective shoulder shrug but used the occasion to bid up the market. Overall, the S&P 500 was higher by over +7% in the first quarter of 2023. The fact that the market has held up so well in the face of these repeated pressures is notable and constructive.

Another source for optimism is the fact that the market remains sanguine about the inflation outlook. Yes, inflation has remained frustratingly high despite the barrage of Fed rate hikes over the past year, but the market remains confident that pricing pressures will eventually abate and return to their previous levels. This is demonstrated by the 5-Year Breakeven Inflation rate, which is not only showing that inflation concerns have come down measurably over the past year when the U.S. Federal Reserve first got started with hiking interest rates, but they have fallen back toward just over 2%, which is roughly the same level that has been anticipated throughout much of the post Great Financial Crisis period.

The ongoing strength of stocks coupled with fading inflation pressures heading toward an anticipated economic recession has set up a constructive narrative of a market that is seeking to look through the economic challenges in the months ahead to the other side where U.S. Federal Reserve interest rate cuts and a rebounding economy await to support higher stock prices.

Fragility. Despite its impressive resilience, the stock market remains fragile in a number of ways.

From a fundamental perspective, the U.S. stock market still has some meaningful shoals to navigate. Most significantly, while stocks notched a high single digit gain in Q1, underlying S&P 500 corporate earnings dropped by nearly -8% on a quarter-over-quarter basis and nearly -13% on a year-over-year basis. With stock prices (“P”) rising and corporate earnings (“E”) falling, this has resulted in a market that has become notably more expensive on a P/E ratio basis. Not only is the S&P 500 trading at a historical premium, which is not typical heading into a likely recession, but at a lofty 24 times GAAP earnings its valuation is now 50% above its historical average for all economic environments, not just recessions. Looking forward, with corporate earnings still at the high end of their range with profit margins likely still in the early stages of compressing, pressure on the broader stock market is likely to remain biased to the downside.

Stocks also face potential headwinds from a technical perspective. Although the S&P 500 Index has established a solid mini uptrend from its October 2022 lows and has cleared some key moving average technical resistance levels in the process, some key hurdles still lie ahead. Leading among these is the ultra long-term 400-day moving average, currently at 4181 and falling. The last time the S&P 500 approached this key technical resistance level was at the end of January, and the rally was subsequently stopped in its tracks and turned back. It is also worth noting that we remain in a sequence of lower highs on the S&P 500, which remains bearish until we see otherwise.

Another more specific concern is the notable lack of responsiveness from a particular area of the market that has been under fire over the past month. While the broader stock market largely looked past the recent banking system turbulence, the financial sector itself remains under pressure. And given that financials basically represent the heart center of the stock market and the broader economy (as the Great Financial Crisis certainly taught us), this is a downside risk that we must continue to watch closely going forward.

Considering the broader financial sector, while it has rebounded following its precipitous decline in early March following the collapse of SVB Financial, its bounce has been generally listless.

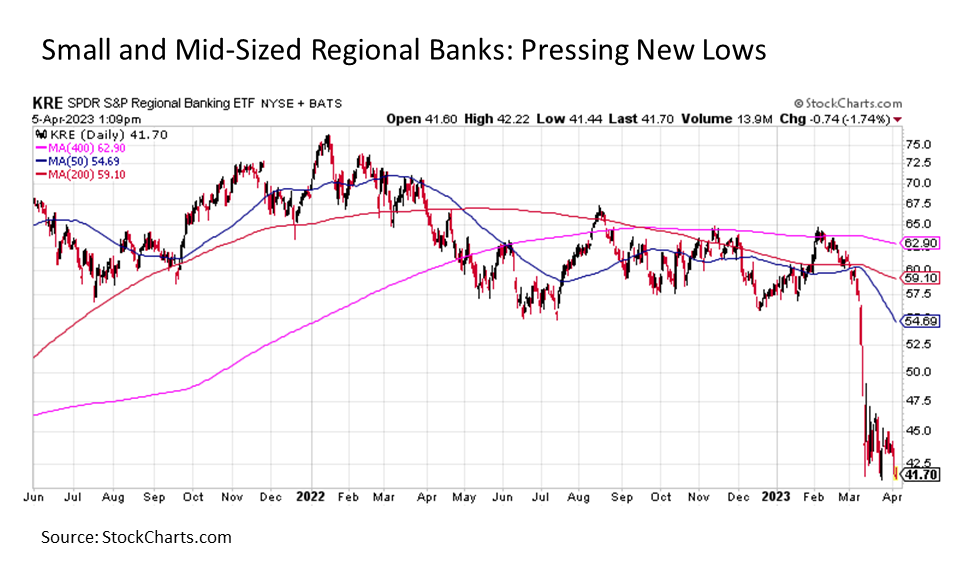

When focusing specifically on the small and mid-sized regional banks that reside at the heart of the recent banking worries, they not only have not bounced, but are threatening new lows.

The persistent weakness in this key segment of the market that had us at the edge of our seats for two consecutive weekends in March should not be overlooked. While the risk of a 1930s style depositor bank run has been alleviated, this does not mean that all the troubles plaguing the banking system today have gone away.

Risk. While it remains to be seen what issue will surface to put the banking system and the regulators that oversee it back on the run, but a key area of concern worth monitoring as we make our way through the second quarter are the pressures building in the commercial real estate market.

Small and mid-sized banks make up the lion’s share of commercial real estate lending. And a number of these same small to mid-sized banks that may already be coping with the ongoing flight by depositors to higher interest rate money market funds are also seeing mounting challenges in their commercial real estate loan portfolios where property values have already fallen over the past year and may potentially decline much further depending on the depth and length of the anticipated economic recession ahead. This has the potential to lead to a compounding situation where declines in commercial real estate values lead to a tightening in bank lending that further exacerbates the decline in commercial real estate values and could eventually culminate in the financial health of the lending banks being called into question by the market. And this is an issue that will not be as easily resolved by government intervention.

It remains to be seen whether commercial real estate challenges start to bubble to the surface, but it is a key downside risk to watch for developments as we progress through the second quarter.

Reward. Of course, it is important to remember that capital markets almost always have their areas of risk and fragility. And despite these persistent challenges, both the economy and financial markets have shown the persistence and resilience to work through these short-term and intermediate-term challenges to make their way higher over the long-term.

The key in navigating markets over time is being mindful of the downside risks and adjusting accordingly while at the same time focusing on the upside return opportunities that are also almost always in abundance at any given point in time. The current market environment as we make our way through 2023 is no exception in this regard.

Eric B. Parnell, CFA Chief Marketing Strategist | Great Valley Advisor Group

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice.

Please consult a tax or legal professional for specific information and advice.

426043-1